Bitcoin’s Worksite Is Quiet, But the Crew Hasn’t Left

ETF outflows and crowded short positions leave the market waiting for its next jolt

Bitcoin has been stuck for weeks. It keeps bouncing between roughly $60,000 and $72,000 and can’t seem to break free. As of Tuesday, it’s hovering near $68,380, down roughly 24% since the year began. If the month closes here, it will go down as the most grueling opening quarter for the asset in eight years.

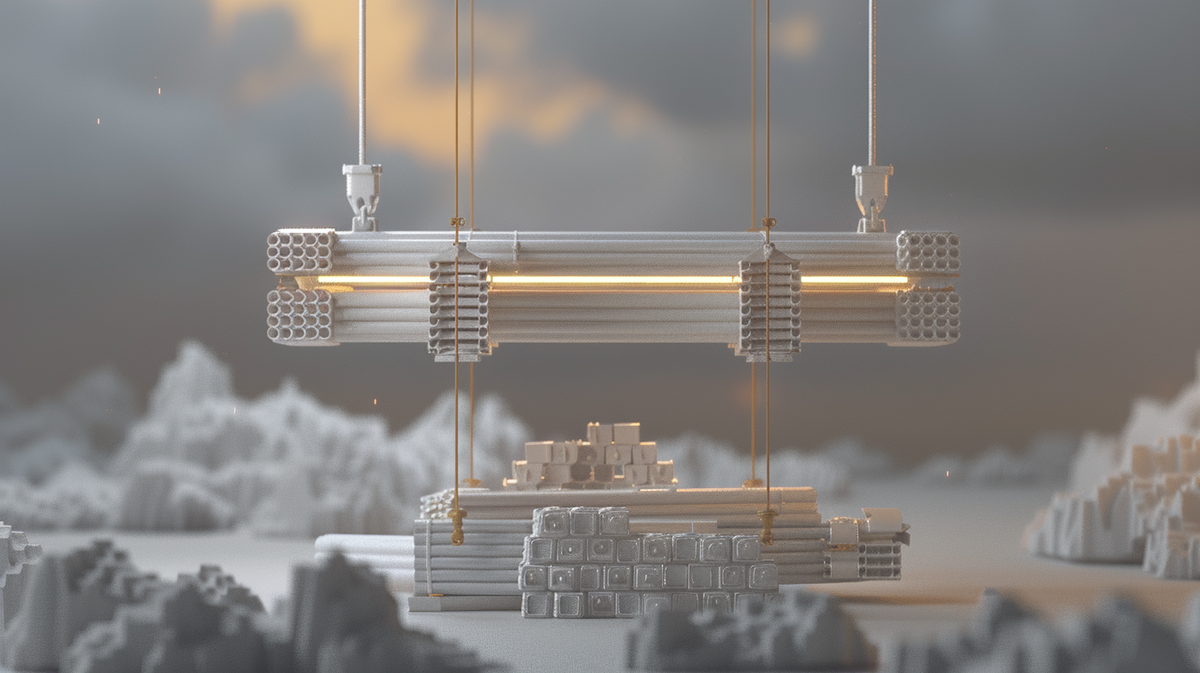

On the surface, nothing looks dramatic. There’s no panic selling, no obvious collapse. But markets don’t need chaos to feel unhealthy. Sometimes they just stop moving with purpose. Every attempt to push higher runs into sellers waiting above, like unfinished beams hanging over a job site.

That’s the mood right now; not fear, more like fatigue.

The Money Flow Problem

The bigger issue is where fresh money is supposed to come from. Spot bitcoin ETFs saw around $133 million leave last week, part of a broader $173 million exodus from crypto funds. It marks the fourth consecutive week of retreats, totaling nearly $3.7 billion in outflows over the last month.

Those ETFs were supposed to be steady capital, the kind that shows up early and sticks around through bad weather. Instead, the recent outflows suggest the support isn’t as fixed as many assumed. Institutional money can still pull back quickly when conviction softens.

Under the Surface, a Different Story

On-chain data looks less gloomy. Larger holders have continued moving coins off exchanges, which usually signals longer-term accumulation. Metrics that track investor profit and loss show the market drifting into a zone analysts often call “hope and fear.” People aren’t confident, but they’re not running for the exits either.

Bitcoin also sits below the average cost basis of newer buyers, which tends to pressure recent entrants. Older holders, though, appear willing to absorb supply. We’ve seen similar patterns before, long stretches where weak hands slowly sell to stronger ones before anything decisive happens.

It doesn’t look like a collapse. It looks more like a pause where the stronger players quietly pick through the leftovers.

While the Bitcoin site remains quiet, the noise has moved elsewhere. Investors have spent the last few days scouring the rubble of the February 6th crash for value, and they’ve found it in XRP – which has sprinted 38% higher since that day, doubling the recovery pace of Bitcoin and Ether. It’s a sign that the capital isn’t dead — it’s just rotating toward perceived value while the giants wait for a catalyst.

Dear Reader,

The world is obsessed with Bitcoin again...

And for a good reason: It just soared beyond $100,000.

But in my opinion, there’s a far better opportunity out there.

It’s a breakthrough the mainstream media is too blinded by Bitcoin fever to see.

I call it “Bitcoin Skimming”... and I outline the whole thing in my latest briefing.

Bitcoin Skimming allows you to “skim” cash into your account thanks to surging Bitcoin market.

And here’s the incredible part…

You don’t have to buy or sell Bitcoin. Not one single penny’s worth.

I spent over a year testing this strategy, along with a small, tight-knit inner circle of readers.

The results have been unbelievable.

During the testing period, we amassed an 85% win rate.

My readers had the opportunity to “skim” $3,615… $4,036… and even $4,898 week in and week out…

In the process, they’ve been able to crush Bitcoin’s returns 6-to-1…

9-to-1…

And even 22-to-1… without risking a dime in the crypto markets.

And these payouts hit whether Bitcoin was going up OR down.

Now you have the chance to join them.

In my latest video briefing, I’ll give you everything you need to “skim” your first payout — and it won’t cost you a penny.

Click here to watch now, while you still can.

Regards,

Larry Benedict

Editor, The Opportunistic Trader

Crowded Shorts Add Tension

Then there’s the derivatives market, which adds its own layer of risk. Short positions have piled up. Estimates suggest a modest move higher - around ten percent - could liquidate billions in bearish bets. The opposite move would trigger much less forced selling.

That imbalance matters. Markets with crowded positions don’t usually drift forever. Eventually, someone gets squeezed, and when that happens, prices can move fast even without new information.

Options traders sense this. Volatility has come down from recent highs but remains elevated compared with calmer periods. Traders are paying for protection, which usually means no one feels fully comfortable.

Macro Relief Isn’t the Same as Liquidity

The wider economic backdrop isn’t providing a clean signal either. Inflation has proved sticky, and with the 10-year Treasury yield easing back toward 4.03% as bond markets reopen from the holiday weekend, the 'higher-for-longer' cloud hasn't fully cleared. That leaves central bank expectations in limbo. The data isn’t weak enough to guarantee easier policy, and it isn’t strong enough to inspire risk-taking.

For crypto, that creates a strange middle ground. Nothing is broken, but nothing is clearly improving either. Liquidity remains tight, and tight liquidity doesn’t reward hesitation.

Waiting for the Next Move

Right now, the market feels like a half-finished project where the tools are still out, but nobody knows who’s in charge. ETF flows show caution. On-chain data hints at quiet buying. Derivatives traders are leaning heavily one way and daring the market to move the other.

That combination rarely stays quiet for long.

The important point is simple: this isn’t panic. It’s a stalled build. And stalled builds tend to end in one of two ways: either funding returns and the project restarts, or someone finally admits the timetable was wrong. Until then, the structure stands, but everyone is watching the beams, waiting to see if the next sound is a hammer or a crack.