Crypto Concrete Is Pouring, But the Site Is Still Unstable

Inflows surge, prices stall, and the long-term build continues.

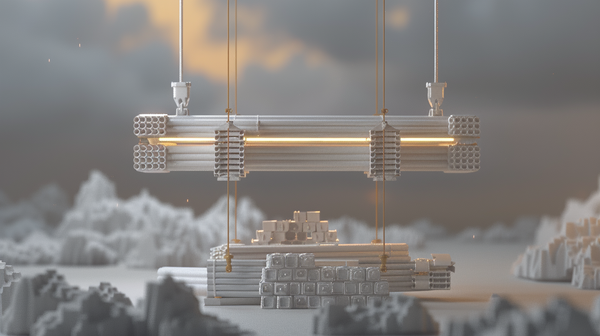

Anyone who has worked on a large construction site knows this pattern all too well:

The crew shows up early, and the trucks arrive on time. Materials pour in fast, and for a few days, progress looks strong.

Then a permit issue hits out of left field. The bad weather you didn't expect shows up, or your foreman changes his plans mid-week. Suddenly, work slows down, and some trucks turn around.

This pattern can also help us understand what just happened in global crypto markets.

According to CoinShares, global crypto investment products logged $2.17 billion in net inflows last week, the strongest weekly total since October 2025.

Most of that money arrived early in the week, before sentiment cracked on Friday and $378 million flowed back out.

To go back to our analogy, the foundation work is happening, but the site's far from stable.

Heavy Equipment Arrived Early, Then the Site Got Noisy

The recent numbers matter because of who was doing the buying.

Crypto investment products issued by large asset managers like BlackRock, Grayscale, and Fidelity absorbed the bulk of inflows.

The early-week pattern looked like this:

- Strong inflows before any major price breakout

- Broad participation across multiple assets

- U.S.-based products leading the charge

This behavior aligns more with strategy than stress. On a job site, it’s the difference between scheduled deliveries and emergency orders.

But by last Friday, the tone changed.

According to CoinShares, geopolitical and policy uncertainty pushed investors to pull some capital back. Diplomatic escalation over Greenland and renewed anxiety over U.S. stablecoin regulations created enough noise to slow things down.

The key point from CoinShares’ research head: underlying demand did not collapse. Flows stayed positive most of the week.

Pauses happen in every well-run project. What matters is that the crew didn't walk off.

The Real Story: Where the Money Went

On failing projects, money leaks. In this case, it’s being placed with intent.

Here’s where capital is concentrated:

- Bitcoin products led with $1.55 billion in inflows

- U.S. spot Bitcoin ETFs alone accounted for $1.4 billion

- Ethereum products drew $496 million

- Solana added $45.5 million

Even smaller allocations tell their own story. XRP funds led altcoin inflows, while Sui, Lido, and Hedera all saw positive additions.

We can think of this as money spread across multiple work zones instead of crowding into a single trench.

Prices Didn’t Explode…Yet

Despite the strong inflows, prices stayed relatively calm.

Bitcoin rose nearly 3% over the week, then slipped below $93,000 as macro concerns returned. Ethereum followed a similar path.

This disconnect is telling. When materials keep arriving, but the structure doesn't visually change, work is happening below the surface. Rebar is being placed. Foundations are curing.

This Wasn’t a Local Job

Regionally, U.S.-based funds dominated, pulling in $2.05 billion. Products in Germany, Switzerland, Canada, and the Netherlands also saw net inflows.

Even blockchain-related equities attracted $72.6 million, extending a recent trend.

On our crypto job site, this tells us a single contractor wasn't pushing a narrative. Multiple crews were operating across jurisdictions, despite late-week disruptions.

The Long-Term Build

This week followed a familiar pattern. Capital entered steadily during stable conditions, and when uncertainty hit, exposure was trimmed at the edges while core positions held.

This sequence mirrors long-term projects everywhere. Conditions change, and some workers step back. However, the work continues because the project still matters.